by Robin Jaca

Don’t wait for tomorrow. Take control of your financial future today! 2025 is the year to protect your wealth, eliminate risks, and build a stable, prosperous future you can rely on.

2025 is the Year to Secure Your Financial Stability

I know a lot of people can relate with me saying that our compensation from the work that we do is only enough to cover monthly dues. Most often than not, the terms “kulang pa nga” come up. This gave birth to people, especially millennials and gen z, looking for additional sources of income.

Unfortunately, based on statistics, 20% of start-up companies fail in their first year and only 50% survive through their fifth year. It’s a sobering reality that starting your own business to secure more compensation is a lot more stressful and riskier than looking for a part-time job.

If you’re part of the population who would rather look for a part-time job than starting your own business, it is difficult for you to perform at the highest level to propel your career because you’re shuffling two jobs. It’s hard to balance it out.

But we still do it, right? Start a business, look for additional jobs, and all of that because, at the end of the day, we have bills to pay and we wanted to get over the hump and live a comfortable life.

So, I want to ask you this.

When was the last time you took a hard look at your finances? For many Filipinos, financial security is often pushed aside in favor of immediate needs or wants. But leaving your wealth unprotected is a risk you can no longer afford. Because when life hit you with the unforeseen, you can watch all your hard work go down the drain as if you have not accomplished anything in life. Trust me, I’ve been there. And there’s nothing harder than hitting rock bottom than realizing that you cannot get out of your rock bottom.

The Numbers Don’t Lie

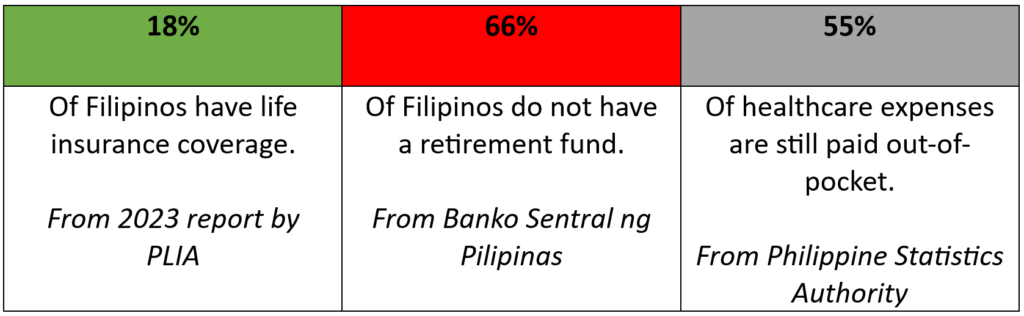

Statistics paint a sobering picture of how underprepared many Filipinos are when it comes to securing their financial future:

The financial security of millions of Filipinos is at severe risk, with only 18% having life insurance coverage, leaving families vulnerable to sudden income loss. A staggering 66% lack a retirement fund, relying on inadequate government pensions that often fail to meet basic needs. Additionally, while PhilHealth offers basic coverage, 55% of healthcare costs are still paid out-of-pocket, meaning a single medical emergency can deplete years of savings.

The True Cost of Doing Nothing

Failing to protect your wealth can derail your financial success in more ways than one:

- Unforeseen Medical Expenses: Without sufficient health coverage, unexpected illnesses can lead to debt or bankruptcy. It’s a common scenario that traps families in a cycle of poverty.

- Inadequate Retirement Funds: Without proper planning, you risk becoming financially dependent on others in your later years. This can strain relationships and limit your freedom.

- Family’s Future at Risk: Without life insurance, your family could face financial instability, forcing them to make difficult decisions like pulling children out of school or selling assets.

The cost of failing to protect your wealth is far too high, as it puts you and your family at serious risk. Without sufficient health coverage, unforeseen medical expenses can lead to overwhelming debt or even bankruptcy, trapping your family in a cycle of poverty. Inadequate retirement savings leave you vulnerable to financial dependence in your later years, potentially straining relationships and limiting your freedom. Most critically, the absence of life insurance jeopardizes your family’s future, forcing them to make heartbreaking decisions, like sacrificing education or selling essential assets. Ignoring these risks today could have devastating consequences tomorrow.

2025: The Year to Take Action

The good news is that it’s never too late to start. Here are four steps to help you start securing your financial health in 2025:

- Conducting a Financial Checkup: Knowing where you are as far as your finances are concerned will play a pivotal role to your road to financial prosperity.

- Get Insured: Whether it’s life, health, or property insurance, protecting what matters most should be a priority. Consider products tailored to your needs and budget. Many providers now offer flexible plans.

- Start a Retirement Fund: Begin saving for your future today, even with small amounts. Explore investment options like mutual funds or time deposits to grow your money.

- Build an Emergency Fund: Aim for savings equivalent to at least three to six months’ worth of expenses. This will cushion you against sudden financial shocks.

Assessing your financial situation is the first step toward building a secure future. Safeguarding your assets through various forms of coverage ensures that you are protected against unexpected risks. Setting aside funds for retirement, even in modest amounts, is key to long-term financial independence. Additionally, establishing a safety net with enough savings to cover several months of expenses shields you from sudden financial setbacks. These actions are vital for creating a stable foundation and securing peace of mind for both the present and future.

A Call to Action

Financial stability doesn’t happen overnight, but every small step counts. By securing your wealth now, you’re not just protecting yourself, you’re building a legacy for your family.

Let 2025 be the year you take control. Remember: the cost of doing nothing is far greater than the effort it takes to get started. It’s time to secure your financial future, and your peace of mind.